Personal Finance Flowchart: Your Visual Guide to Financial Success

Last updated: December 2024

Introduction

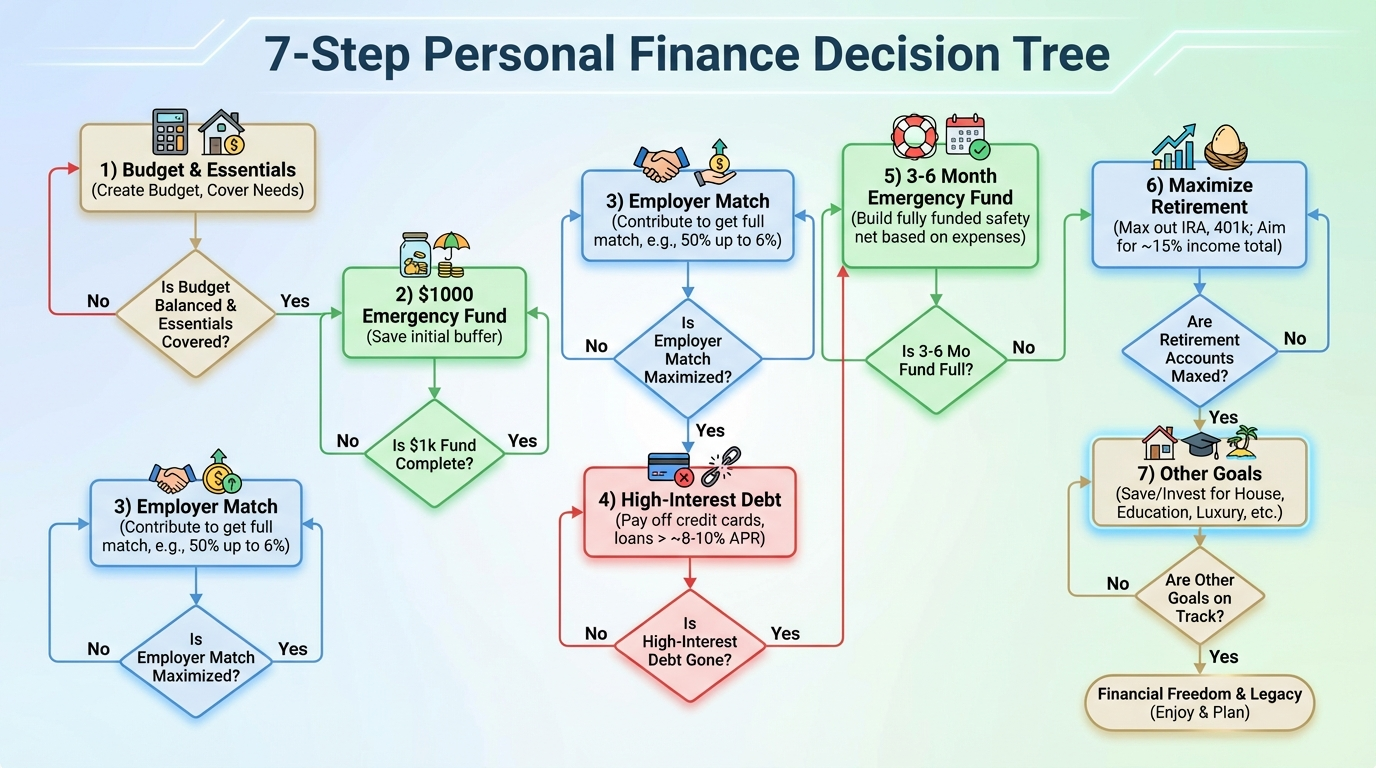

Managing personal finances can feel overwhelming when you're juggling multiple financial goals, debts, and savings priorities. A personal finance flowchart provides a clear, visual roadmap that takes the guesswork out of where your next dollar should go.

This decision tree approach to money management has helped thousands of people transform their financial lives by providing a logical, prioritized framework for every financial decision. Learn how to create and use your own financial flowcharts with tools like Ainfographic to visualize your path to financial success.

Table of Contents

What is a Personal Finance Flowchart?

A personal finance flowchart is a visual decision-making tool that guides you through prioritizing your financial goals and actions. Starting with your income, it asks a series of yes/no questions to determine the optimal allocation of your money across various financial priorities.

The flowchart method removes emotional decision-making from financial planning. Instead of wondering whether to pay off debt or invest more, or whether to increase your emergency fund or contribute to retirement, the flowchart provides clear guidance based on sound financial principles.

The most famous personal finance flowchart originated from the Reddit r/personalfinance community and has been refined through thousands of user experiences and expert contributions. This community-vetted approach incorporates collective wisdom about common financial situations and optimal strategies.

The Basic Structure of a Personal Finance Flowchart

Step 1: Create a Budget and Cover Essentials

The flowchart always begins with ensuring you can cover basic necessities—housing, food, utilities, and essential transportation. Before any other financial move, you must have stable ground to stand on.

Step 2: Build a Starter Emergency Fund

The flowchart typically directs you to save $1,000-$2,000 in a readily accessible savings account. This small buffer prevents minor emergencies from derailing your financial progress.

Step 3: Capture Employer Retirement Match

If your employer offers a retirement plan match, the flowchart prioritizes contributing enough to receive the full match. This represents an immediate 100% return on investment that no other financial move can match.

Step 4: Pay Off High-Interest Debt

With basics covered and free retirement money secured, the flowchart directs you toward eliminating high-interest debt, typically defined as anything above 7-10% interest. Credit cards and predatory loans fall into this category.

Step 5: Expand Your Emergency Fund

Once high-interest debt is eliminated, the flowchart guides you to build a full emergency fund covering 3-6 months of expenses. This substantial cushion protects against job loss, medical emergencies, or other financial shocks.

Step 6: Maximize Retirement Contributions

With debt controlled and emergencies covered, the flowchart directs you to maximize tax-advantaged retirement accounts like 401(k)s and IRAs, building long-term wealth efficiently.

Step 7: Save for Other Goals

Finally, with retirement on track, the flowchart guides you toward other financial goals—saving for a house, building taxable investment accounts, paying off lower-interest debt like mortgages, or funding specific projects.

Why the Flowchart Order Matters

The sequence in a personal finance flowchart isn't arbitrary—it's based on mathematical optimization and risk management principles that maximize your financial security and growth potential.

Employer Match First

Securing employer match money first makes sense because it provides an immediate, guaranteed return that beats any other financial move. Passing up free money to pay extra on a 5% student loan means losing a 100% return for a 5% benefit.

High-Interest Debt Priority

Prioritizing high-interest debt elimination recognizes that paying 18% interest on credit cards exceeds the return you'd likely earn from most investments. The guaranteed return from debt elimination often exceeds the uncertain returns from investing.

Emergency Funds Before Aggressive Investing

Building emergency funds before aggressive investing protects you from having to liquidate investments at inopportune times or taking on new debt when emergencies strike. This foundation provides financial resilience that enables all subsequent wealth-building.

Tax-Advantaged Accounts First

Maximizing tax-advantaged accounts before taxable investments recognizes the power of tax savings compounded over decades. A dollar in a Roth IRA growing tax-free for 30 years significantly outperforms the same dollar in a taxable account due to tax drag.

Visualize Your Financial Plan

Create a personalized financial flowchart with Ainfographic. Design clear, visual decision trees that help you stay on track with your financial goals.

Customizing the Flowchart for Your Situation

While the standard personal finance flowchart provides excellent general guidance, individual circumstances may warrant modifications.

Job Security Considerations

Job security considerations might influence emergency fund size. Those in volatile industries or with specialized skills might prioritize larger emergency funds before aggressive debt paydown or investment.

Family Situations

Family situations affect priorities. Parents might prioritize college savings differently than the standard flowchart suggests, while those caring for elderly parents might adjust the emergency fund recommendations.

Geographic Factors

Geographic factors matter significantly. High cost-of-living areas might require larger emergency funds, while those in areas with strong social safety nets might adjust certain priorities.

Health Considerations

Health considerations could shift priorities. Those with chronic conditions might maintain larger emergency funds and prioritize HSA contributions more aggressively.

Debt Interest Rates

Debt interest rates create gray areas. The flowchart often treats 4-7% interest debt as debatable—some choose to aggressively pay it off, others prefer to invest for potentially higher returns. Your risk tolerance and peace of mind preferences guide this decision.

Common Flowchart Questions and Answers

Should I pay off my mortgage early?

The flowchart typically says no if you're already maximizing retirement accounts and have other financial priorities covered. Mortgages usually carry relatively low interest rates, and the money might grow more in investments. However, the psychological benefit of being debt-free has real value for some people.

What about saving for a house down payment?

The flowchart generally places this after maximizing retirement matches but the timing depends on your timeline and housing market. If you're planning to buy within 2-3 years, you might adjust the flowchart to prioritize down payment savings earlier.

Should I save for my children's college?

The flowchart philosophy suggests securing your own financial future first—specifically retirement. The reasoning: your children can borrow for college, but you can't borrow for retirement. However, many parents choose to prioritize some college savings earlier for peace of mind.

What if I have multiple debts with varying interest rates?

The flowchart uses avalanche method logic—highest interest first—for mathematical optimization. However, the snowball method (smallest balance first) works better psychologically for some people, and motivation matters in personal finance.

How do I handle unexpected windfalls?

Work through the flowchart from your current position. The flowchart helps you allocate bonuses, tax refunds, inheritance, or other lump sums optimally rather than spending impulsively.

Using the Flowchart as a Financial Planning Tool

Review Regularly

Review your position regularly, ideally quarterly. Life changes constantly, and your position in the flowchart shifts as you complete steps and encounter new circumstances.

Document Your Progress

Document your progress by marking completed flowchart steps and tracking dates. This record provides motivation by showing how far you've come and helps you see patterns in your financial journey.

Share with Family

Share with family members to ensure everyone understands financial priorities. The flowchart's visual nature makes it easier to discuss financial decisions and align on priorities.

Revisit During Life Changes

Revisit during major life changes like marriage, divorce, birth of children, career changes, or inheritance. These events might alter your path through the flowchart significantly.

Combine with Specific Goals

Combine with specific goals by using the flowchart for overall structure while maintaining separate tracking for specific objectives like vacation savings or car replacement funds.

Beyond the Flowchart: Advanced Considerations

Tax Optimization Strategies

Tax optimization strategies aren't fully captured in basic flowcharts. As your financial situation grows complex, tax-loss harvesting, Roth conversion strategies, and asset location decisions require deeper analysis.

Estate Planning

Estate planning considerations emerge once you've progressed far into the flowchart. Wills, trusts, beneficiary designations, and inheritance planning require professional guidance beyond flowchart logic.

Insurance Evaluation

Insurance evaluation deserves regular attention alongside flowchart progression. Life, disability, liability, and long-term care insurance needs evolve as your assets grow and family situation changes.

Charitable Giving

Charitable giving strategies might not fit neatly into flowchart logic. For many people, charitable contributions represent values-based decisions that transcend pure financial optimization.

Business Owners

Business owners and self-employed individuals face flowchart modifications around business investment, irregular income smoothing, and complex retirement account options that the standard flowchart doesn't fully address.

Creating Your Own Personal Finance Flowchart

1. Start with the Standard Framework

Start with the standard Reddit r/personalfinance flowchart as your foundation. This community-tested framework covers most situations effectively.

2. Identify Your Unique Circumstances

Identify your unique circumstances that might require modifications. List your debts with interest rates, income sources, employer benefits, family obligations, and specific goals.

3. Sketch Modifications

Sketch modifications on paper first, working through hypothetical scenarios to ensure your customized version maintains logical flow and doesn't create circular logic or priority conflicts.

4. Test Your Flowchart

Test your flowchart by working through it with real numbers from recent paychecks. Does it provide clear guidance? Are there ambiguous decision points? Refine as needed.

5. Get Feedback

Share with a financial advisor or knowledgeable friend for feedback. Fresh perspectives often identify blind spots or opportunities for improvement.

6. Create a Digital Version

Digitize your final version using flowchart software like Ainfographic, which makes it easy to create professional flowcharts with drag-and-drop functionality. Having a clean, visual reference you can easily access and update proves invaluable.

Conclusion

A personal finance flowchart transforms financial decision-making from confusing and stressful to clear and systematic. By providing a prioritized framework based on sound financial principles, it helps anyone—regardless of income level—optimize their financial decisions and build lasting wealth.

Whether you follow the standard Reddit flowchart exactly or customize it for your unique situation, this visual tool brings clarity to the often-overwhelming world of personal finance. Start today by identifying where you currently sit in the flowchart, then follow the path toward financial security and freedom.

Create Your Financial Flowchart

Design a personalized financial flowchart with Ainfographic. Visualize your path to financial success with professional flowchart tools.

Start Planning Your Finances